EBIDTA is a flawed measure of earnings that is commonly mistakenly but commonly used as a proxy for the earnings of a business. Interest, debt, taxes, and amortization are real costs to a business and generally reflect real charges against earnings. Additional CAPEX and working capital required to maintain inventory levels or post-tax capital spend to maintain a competitive position in a market are material costs that affect the money that can be distributed from a business.

EBIDTA as a measure of a business’s earnings will produce radically different results in valuation, projected available capital, and most of all return on investment. To illustrate why this is the case let’s start with an analogy.

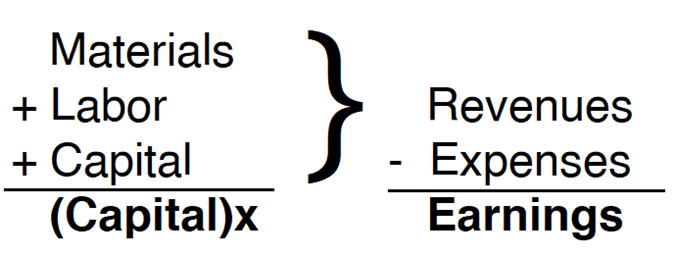

A business, in its most rudimentary form, is a machine that takes the inputs of materials (M), labor (L), and capital (C) and creates an output of capital (Cx) greater than what existed before the combination.

If a business were a simple equation it would be as follows: M + L + C = Cx

M + L + C = 1 and Cx should be greater than 1.

Any machine that fails to produce more than a dollar of earnings for each dollar put in fails the test of a business. The dollar that goes into the machine must be a dollar that can be taken out and used for other purposes without harming the continuing operation of that machine. A business is not more complex than this.

Translated to finance we see that the equation for a business is as follows:

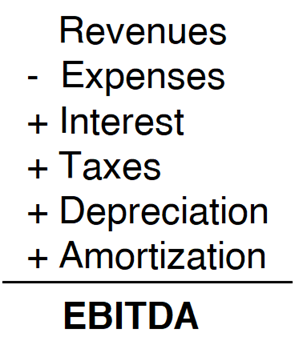

If we simplify a business to these components of inputs and outputs we see that EBITDA adds a layer of complexity to the business equation. Interest is an expense, tax is an expense, depreciation is capital that must be put back into the business along with amortization.

EBITDA as a proxy for earnings or capital changes the financial equation to:

The effectiveness of the machine becomes less clear. How much money needs to go into the machine to have it produce more money that can be taken out?

Each variable by its own is critical to the earnings picture of a firm. Let’s evaluate why one by one.

Interest expense is tied to debt obligations due to another party. At least as long as the firm is a going concern and not able to claim protection from its creditors. It is a literal claim on the earnings of the business which comes ahead of the legal rights of the owners of the business. Creditors must receive their money out of the machine before the government in the form of taxes.

Just like a repo man can take possession of your home if you don’t pay the mortgage. Interest expenses are not accretive to return on the coins the machine will produce. They might be an accessory to it, helping provide capital to make the machine bigger or better, but they always represent a real cost.

Taxes are an annual cost of doing business. It is a direct cash charge on some percent of what the machine produces. It’s a real expense and can be of no advantage in evaluating the effectiveness of the machine to exclude taxes. Consider too that the tax picture of a company is affected by its debt and deprecation expenses that can be of a small benefit to owners. Tax law is riddled with incentives that regularly evaluate the nature of companies that use debt and are capital intensive and provide benefits for the risk of deploying those funds. EBITDA obfuscates this benefit.

Next, let’s consider depreciation. Depreciation for most companies generally represents the minimum amount of earnings that need to go back into the company to continue operations over time. Minimum Capex spend will roughly mirror depreciation.

As a non-cash charge, it can be said that depreciation adds to the cash on the balance sheet. The argument for using EBITDA is that the money could otherwise be distributed. This is true. But what is the cost?

I can take the oil out of my engine and get a few miles down the road on the residue. But at a certain point, the oil must be put back or the engine will stop functioning. Generally, deprecation expenses are no different.

Amortization accounts for the loss of an intangible assets over time.

The biggest problem with EBIDTA as a financial metric

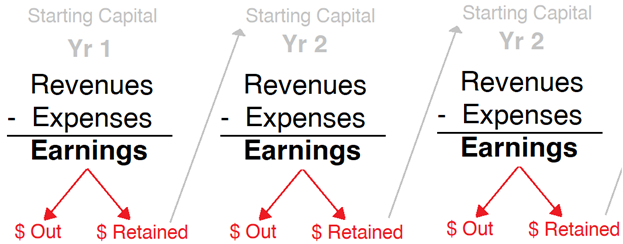

Now consider the biggest issue with EBITDA. It makes understanding how much money needs to be left in the machine extremely complex.

Virtually every business, with extremely rare exceptions, needs to put some of the money it makes back into the company over and above deprecation expenses. Why is this?

A little thing called competition comes into play. Most companies face perennial threats from competitors who want to grow their share of earnings by taking market share away from them. Just like medieval Europe fighting over fiefdoms, warring companies will jockey for a share of customer’s wallets.

Competition acts like an arms race. If a competitor spends more on marketing you must generally spend more on some form of marketing. Extrapolate this to more productive equipment, the best staff, better software, superior customer service, you name it.

Over time this competition generally forces down prices and consumers’ benefit. But the effect on the business machine is that the number of coins you get out of it by putting in new coins goes down over time. Exhausted by war, most machines will continue to exist in a niche until they can no longer survive.

We also live in an inflationary world. Every year, the price of paying workers, marketing, and every ancillary expense will march steadily upward. Prices, unless the company is well-positioned may not be able to move proportionally upward. As a result, the company must spend some of its earnings from the prior year to keep up or catch up in the coming year or period.

Evaluating the ongoing need to redeployed earnings with EBITDA becomes impossible. The capital that becomes the starting or additional available capital in the subsequent year only occurs after the expenses which are added back in the EBITDA view of earnings.

In the event that I want to value a business, I need to be able to clearly project future cashflows or get a clear picture of a historical average. If I want to know the value of something I need to be able to discount future cash flows back to the present or present a fair multiple of the earnings that can come out of the business.

As an investor, if I put money into an investment my return is going to be a function of the money that comes out of the investment either on a recurring basis or when the investment is sold. A business investment is a bond with often irregular coupon payments.

Any investor worth their salt is going to fight the natural tendency to lie to themselves about how well they can do in an investment. For an investment to be a real investment, the money must eventually come out, multiplied greater than what was put in. An investor will want to know how soon the money will come out of the investment and at what volume.

Investors who are not lying to themselves to justify a bad investment will consider the return on capital on a post-tax basis. Money put into an investment by an individual or a business typically occurs post-tax in most cases.

Companies don’t always pay dividends. Many companies do not distribute or have the ability to distribute a significant portion of their earnings each year. Some companies have tremendous opportunities to re-deploy the money they make favorably into the next year or quarter. In the case of firms like Amazon period can be for decades.

If a company is reinvesting all of its profits and pays no dividend then the long-term value of the company will be determined by its ability to redeploy money favorably. As an investor, the result would be that the money invested may remain illiquid for an extended period of time. The risk lies both in the ability to transact the shares at a fair price at a future date or the company’s ability to eventually pay out its earnings.

From an investment perspective, EBITDA does not provide a clear picture as to how effective the machine is going to use capital and return it to owners.